How to protect your Visa card information?

We all want to protect our Visa card information, for obvious reasons. But sometimes even the most careful people let their guard down and discover suspicious transfers made from their accounts. Situations like this are stressful, to put it lightly. The good news is that there’s always a way to prevent this from happening and even solve such situations. Whether you’re here for damage control instructions or tips for safety precautions, in this article you will find it all.

Agenda:

When you receive the Visa card

Now that you have your Visa card, you’re probably eager to use it. But hold on, let’s make sure that it will cost you only as much as you spend and not a cent more.

Turn on account alerts

Having your account alerts on can help you react quickly and efficiently, as reports of suspicious and possibly fraudulent activities are sent to you instantly. You can receive these notifications in your email, via text message, or as a push notification.

Here’s how you can turn on account alerts in the Paysera app:

Step 1. Go to the Paysera app and tap on the settings icon

Step 2. Under Settings, choose “Notifications”

Step 3. Under Payments, tap on “Outgoing transfers” to make it blue

Step 4. Choose which account you want to receive notifications from. You can select one or several options

Step 5. Choose the amount you want to be notified for

We also recommend choosing the “Confirmation requests” setting, meaning that you’d need to use the Paysera app in order to confirm Logins and Transfers that were made via Paysera online banking.

And, if you want to maximise security even more, you may be interested in the setting called “Use private notifications”. This will hide incoming transfer information, specifically the sender’s name and the amount of money received.

Use security software

When it comes to security software, most people assume that it only applies to computers.

And they’re not wrong, but that only covers half of security precautions. As more and more people are beginning to use their mobile phones for money transfers, smartphones become a juicy target for hackers, hence additional security is crucial.

For starters, we recommend looking into reliable antivirus and password management software.

Things to always remember

If you followed all of the mentioned steps, you’re off to a great start in protecting your Visa card information. However, there are things that you need to always remember in order to keep it that way.

Never share your personal information

Yes, this is an obvious one. But you’d be surprised how often people get carried away for just one minute, which then causes problems that take a lot more time to fix.

Even if your bank balance is currently empty, scammers can still use your account as a medium where they place the money that they stole from other people. This could potentially leave you with legal issues even though you had nothing to do with it.

That is precisely why you should never share your account information via email, text messages, phone calls, other mediums, and even in person. Paysera, or any other legitimate organisation for that matter, will never ask you for your account information, including your password.

Most common phishing scams come from phone calls, text messages, fraudulent websites, and suspicious emails, where scammers disguise themselves as a legitimate bank or another known company. These scams tend to pressure you under false pretences and possibly even threats.

Keep an eye on calls and messages from ‘Paysera’

We are aware that scammers are becoming more advanced in using modern technologies and tactics to extract people’s Visa card information. In fact, they go as far as to display their phone numbers as if they were calling or texting from Paysera.

As a rule of thumb, there are two things that you need to remember:

- Paysera will never send you text messages asking you to log in or inquiring for your account information. You may only receive text messages that inform you when you reserved money if you set up your settings accordingly. We will not include a link in such text messages.

- Paysera will call you back, but it will never call you first. If you didn’t call us, but you’re receiving a call with Paysera’s name displayed on the screen, we advise you not to pick up, as it’s most likely a scammer masquerading as Paysera. In this case, the safer option would be to decline the call.

Use reliable websites and don’t save your Visa card information

E-commerce is being constantly targeted by hackers in order to acquire people’s sensitive financial information. In fact, did you know that in 2021 online payment fraud was estimated to have caused a loss of 20 billion U.S. dollars globally? This is an increase of over 14% compared to 2020.

Here’s what you should always keep an eye out for when you visit online stores:

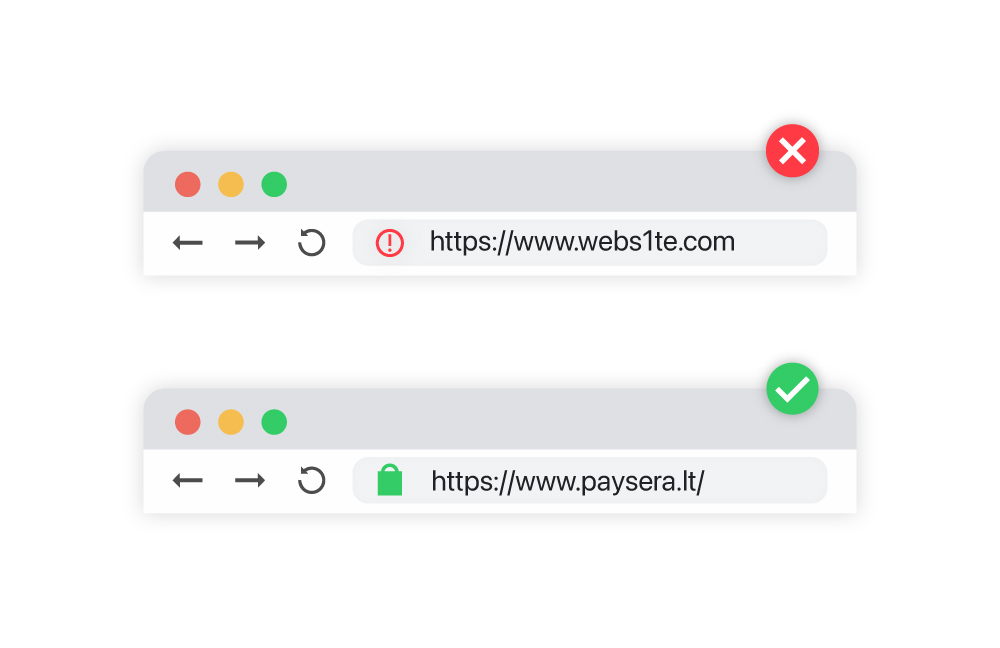

- Check if the online store is legitimate by searching for it on Google and access it from there instead of following links or typing the domain name

- Never allow an online store to store (pun intended) your Visa card information, no matter how safe it may seem

- Double-check the website address to make sure you’re in the correct place

- Examine links in Google search results as scammers use legitimate-looking advertisement banners for fraudulent websites

- Remember to log out on public computers

Check your account regularly

If you check your bank account regularly, and you know your expenses, you are more likely to catch suspicious activity. The sooner you catch it, the sooner it can be solved.

Regularly check – and subscribe for notifications – if your account has been compromised on a public data leak monitoring service like https://haveibeenpwned.com/.Topup your Visa card only when needed

We are officially done going through the standard safety measures. But when it comes to safety, you can always go the extra mile. As the saying goes, better safe than sorry.

We recommend keeping money in your bank account and only transferring it to your Visa account when needed.

When you buy online, pay via banks or through payment platforms

You already know what happens when you shop online through unsafe online stores.

However, even when you use a secure internet network and buy from seemingly safe online stores, if you type your Visa card information directly into the website, you still risk your data being stolen.

Fortunately for you, we’re about to tell you a secret: if you pay through your bank or an online payment gateway, the online retailer can’t see your Visa card information. This essentially means that if the online retailer is sketchy or gets hacked, your information won’t be there to steal.

Examples of such payment platforms include Paysera, PayPal, Apple Pay, Google Pay and others.

In case the worst happens (or you think it has)

So you think that your Visa card information was leaked. First of all, take a deep breath. We can fix this together, just follow a simple procedure and if it comes to that, leave the rest to us.

Step 1: Double-check the transfer

Try not to lose your mind after a single glance at an expense you don’t recognise right away. Double, triple check your balance and where it was moved. It is possible that it’s simply something that you can’t remember right away.

Step 2: Contact the recipient

In case you have no recollection of the suspicious payment, the recipient will always be shown. We strongly advise you to contact the recipient directly, ask them what the payment was for, and ask for a refund if you disagree with the transfer.

Step 3: Freeze your card and call your bank immediately

If you’re confident that something suspicious is happening, and it’s not something that you initiated yourself, or you accidentally clicked on a sketchy link, you can start by freezing your Visa card via the Paysera app. This will temporarily block your Visa card, and it can be unblocked by you at any time.

Here’s how you can temporarily block your Visa card:

- Go to the Paysera app and choose “Cards” at the bottom

- Tap on the “Freeze” option

If someone has your Visa card information, they won’t be able to do more harm, since your card is now frozen.

Finally, all you need to do now is to call us right away. Don’t wait for another day or week, as the investigation can only be done if a customer reports a problem within no later than 3 months. From here on out, we will handle the rest and keep you updated.

You can find the relevant Paysera client support contact information here.