This is what Paysera has planned for 2022

Super app with all the bells and whistles 💫

Paysera started transitioning towards a super app back in 2021 – but some might even say that from the very beginning of the app's existence we started moving in that direction without even realising it ourselves.

The first integration into the app was Paysera Tickets – through the app you can buy tickets to various events that are distributed via our system.

On top of that (may vary by country), you can also access various loan providers and the most popular e-shops straight from our mobile application.

But this is just the start – a scratch on the surface. More exciting things are ahead

👇

Status page ✅

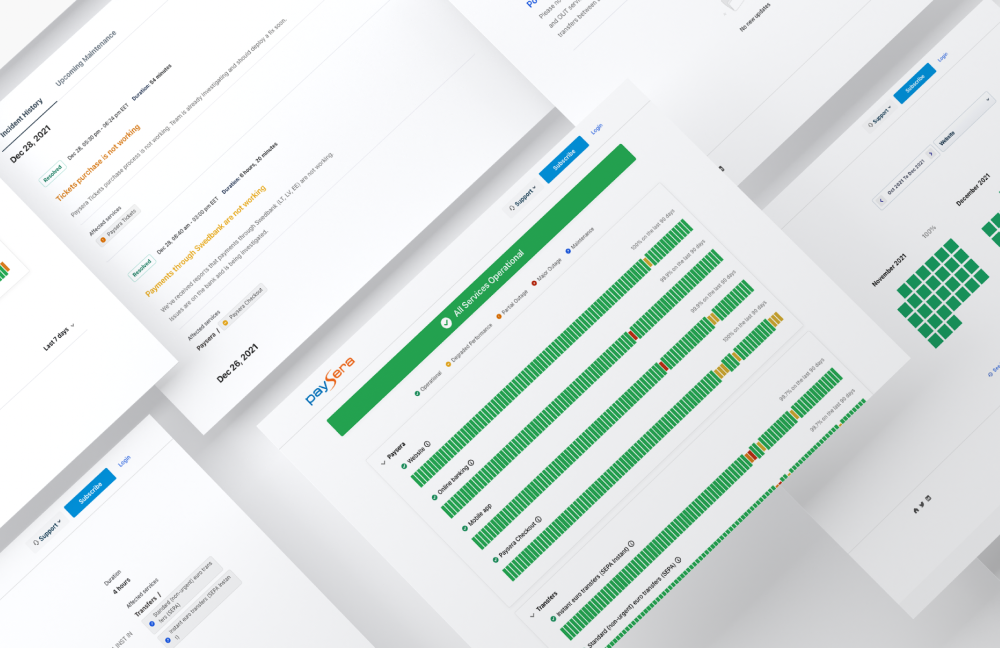

Not so much of a feature as it is an essential part of our communication with clients. Within the next few days, we will widely share with you our Status page where all clients can see upcoming planned maintenance work, as well as unexpected outages or disrupted services if there happen to be any.

This will not only relieve our client support team but also give peace of mind to our clients, who will always know where to check if everything is ok with the services.

Paysera bank in Georgia 🇬🇪

With strong new partners on board and a pending banking licence in Georgia, we expect to have a Paysera bank there by the end of next year.

Virtual cards 💳

Another highly anticipated feature, which is right around the corner. Virtual cards will mean that a wider range of our clients can benefit from Visa payment cards.

KYC for partner online sites ℹ️

As a financial institution, we know our clients – that’s what KYC stands for. We have well-developed processes and IT solutions for it, and in 2022 we are planning to share this superpower with our clients that also need to identify their customers – for example, investment platforms.

Let’s stop here for now, although there are still many things that cannot yet be revealed. Let’s hope that our ideas see the light in the upcoming months and help thousands of clients to manage their finances and daily habits more easily with our solutions. Have a productive year, believe that change is possible, and, of course, stay healthy.