Why is my Paysera account blocked or restricted?

If you ever had your account restricted or even closed by a company that you entrusted your money to – you know how frustrating it might be. We too, while being on the other side of the table, find it very upsetting to block our clients’ accounts, and always do our best to make sure it is absolutely necessary. And yet, it is something all financial institutions sometimes have to do to ensure the safety of their customers and people in general.

We often see people discussing this topic in various forums as well as on social media, so we decided to give you some insights on why some people find their Paysera account blocked or restricted.

Legal requirements for us

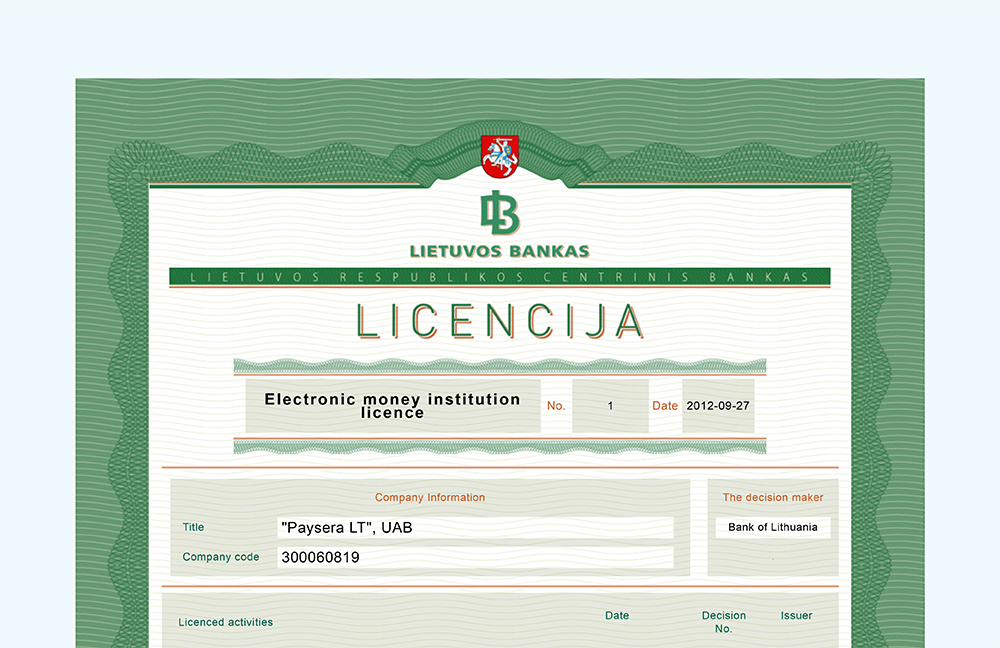

Paysera is a licensed electronic money institution. This licence allows us to serve thousands of clients around the world and provide them with various services, from personal and business accounts to payment cards, money collection in e-shops, and more.

However, with great power comes great responsibility. And so, our company needs to follow loads of rules and requirements from our regulator – The Bank of Lithuania, as well as our partners, such as the payment card provider Contis, and international regulations such as anti-money-laundering and counter-terrorism-financing rules.

But, to clarify - if you see that your account is restricted, it does not necessarily mean that we suspect your involvement in money laundering or other illegal activities.

It might be that you did not provide us with all the necessary information that is required from our clients within a certain period of time or that the information provided was fabricated – meaning that the service agreement is broken. And so we do what all banks have to do in such situations– restrict the account.

Restricted, closed, blocked, and frozen – what’s the difference?

All these words don’t sound great. However, some of them don’t mean a permanent goodbye, while others do.

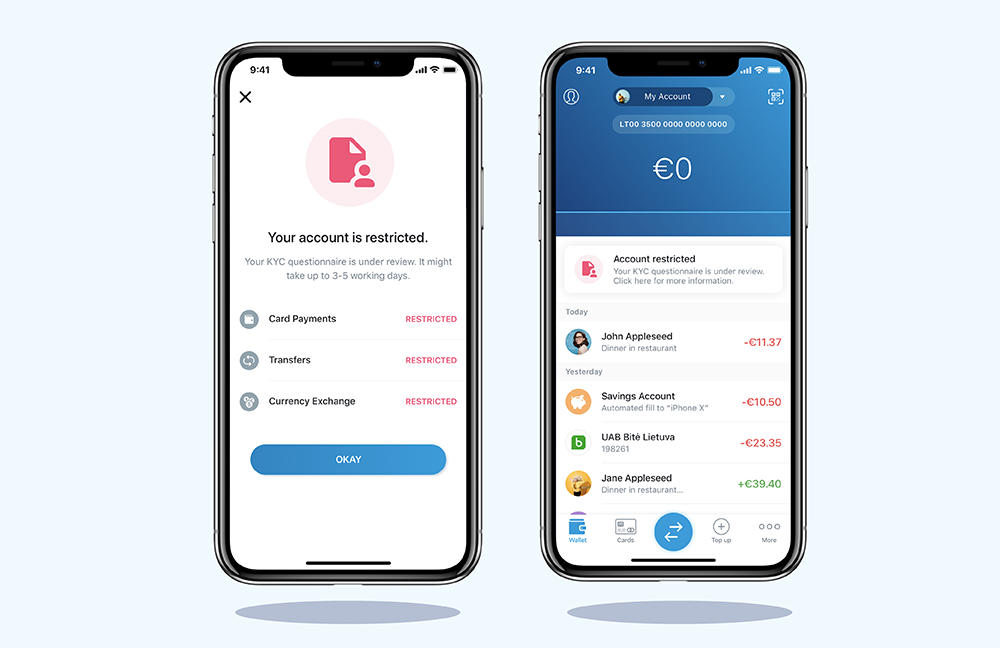

Account is restricted

In many cases, restricted account means that a bank might be suspecting some illegal activities connected to your account. It does not necessarily have to be you who is in the wrong. We might notice unusual activity on your account, and we will want to make sure that it is really you who is using the funds.

Not providing necessary details can only increase the suspicion of questionable activities. We might be waiting for your ID, company documents (if you have a business account), KYC (Know your customer) questionnaire, information about the origins of your funds, and so on.

Check your account, your email (including the SPAM folder), and you should see a message from us. Follow the instructions carefully and provide everything that is requested, and if we don’t have any more questions, your account will be active in a day or two.

Account is closed

If you try to log in to your Paysera account and you can’t – it is possible that your account was closed. Such cases are rare and executed only when it’s absolutely necessary. It probably means that you did not stick to our service agreement – maybe you shared your account with other people, you lied about your financial activities or about your identity, used the account to trade crypto currencies, or even worse – used the account for illegal activities and fraud.

If you had money in your account that belonged to you (was not lured out from other people) we will return it to you or to the account that sent you the money once you provide us with the necessary details, prior to closing your account. At this point, you will be restricted from using our financial services.

Frozen or reserved funds

Missing information. It is possible to find that only one of your transfers was temporarily stopped – reserved or frozen as some people call it. Financial institutions may do so when some information about the transfer is missing or it causes extra suspicion. We might ask for more details about the receiver, the origin of the money, or the purpose of the payment. So the more information you provide when filling out the transfer form – the less likely it is to cause any trouble in the future.

Tax avoidance and information sharing. There are other reasons for a certain payment or funds to be put on hold. As a widely operating financial institution, Paysera is part of the PLAIS system (Cash Restriction Information System). It is a Lithuanian information sharing system that unites banks, bailiffs, tax institutions, and other relevant institutions.

Although this system is Lithuanian, institutions like the State Tax Inspectorate share information (such as the fact that a certain person has an account with us) between equivalent organisations in other countries. Therefore, if someone is avoiding paying taxes or something similar, us or any other bank of this person might get an order to hold certain payments. And then you see them as reserved or frozen.

Acceptance of online payment. If you are accepting online payments, you might see quite a few reserved transactions. All of the possible types of payment that get reserved are listed on our website.

When collecting payments online, most of the time you will receive the payment right away when the buyer completes the order. However, if the buyer pays by card or, for example, covers the bill at a physical kiosk, then you will see their payment as reserved. It means that they have already paid for the order and the goods can be dispatched to them but you will be able to use these funds only when the partner (for example the kiosk or payment card provider) releases those funds to us. Such reservation might normally last for up to 3 days, although sometimes it’s a matter of hours.

Incorrect details. Sometimes, of course, the transfer is displayed as reserved if you entered the incorrect account number of the receiver. Double-check it and cancel the payment if necessary. If that is not the case and we do need some more info – you will be contacted by the responsible team.

Blocked

This term is less frequently used and mostly applies to your card. If your Visa payment card is blocked – it might mean that you have breached the card rules and we can no longer provide you with this service.

You can also block the card yourself – for example, if you lose it or suspect that somebody else knows your PIN or other important details. If you blocked your card – you can order a new one via our online banking or the mobile app.

Why is my Paysera account restricted?

Most common reasons:

1. Passport or ID not provided

If you already have a Paysera account but your ID or passport is no longer valid, you will be requested to update these international documents. If you don’t do this within the given period – your account will be restricted until you provide us with the necessary information.

2. Documents (business) not provided

If you are a company and, when asked, you are unable to provide documents about the source of your funds or final beneficiaries on time – your account might be restricted until you do so. These documents should be official and we should be able to verify them using sources such as your national registry centre or something similar.

3. Using the account for cryptocurrencies

When opening a Paysera account you agree to our terms and conditions, one of which is not to use our services for cryptocurrency trading. If even after the warning you continue such activities – we will restrict your access to our financial services. We are open about this restriction from the beginning, so please, don’t try to trick the system and do it anyway. 🕵️♀️

4. Incorrect information about your activities

Be transparent about what you do and where you normally get funds from, provide us with complete and accurate information. If you write that you are a student but we notice you are receiving large amounts of money from different people – we will find it suspicious and you will be asked to provide more information. So better do it from the very beginning to not face any inconvenience later on.

5. Providing financial services without our knowledge and consent

If your company, after opening a Paysera Business Account, changes the services it provides – we should be informed about it. For example, if you start dealing with finance, we will have to give you additional consent to use our services. The full list of services that require this is listed in the service agreement.

6. Using proxy servers to log in to the account

Using proxy services is not against our rules on its own. However, if using an anonymous one, you might find yourself unable to log in to your Paysera account. Otherwise, we would find it suspicious to see you logging in from a different part of the world every time you use the account.

7. Sharing the login/password with third parties

Don’t share your account with others and don’t let other people open an account in your name. It is against our rules and it will do more harm for your name rather than the person who will be using your account. The person using the account under your name can cause you serious trouble by getting you in debt, taking credits, acquiring your medical history, ordering various services from state institutions, as well as signing documents under your name. Therefore you should be the only person that has access to it and if you think that somebody else might know your login details, you should change them immediately.

If your account is restricted or closed – carefully read our terms and conditions again to see what the reason for this is. Besides, look for the messages from us and don’t forget to check your SPAM. Otherwise, you can always contact us yourself.

However, it’s always better not to reach this step and if you do – try to provide all the information ASAP, so we can let you use our services fully again.

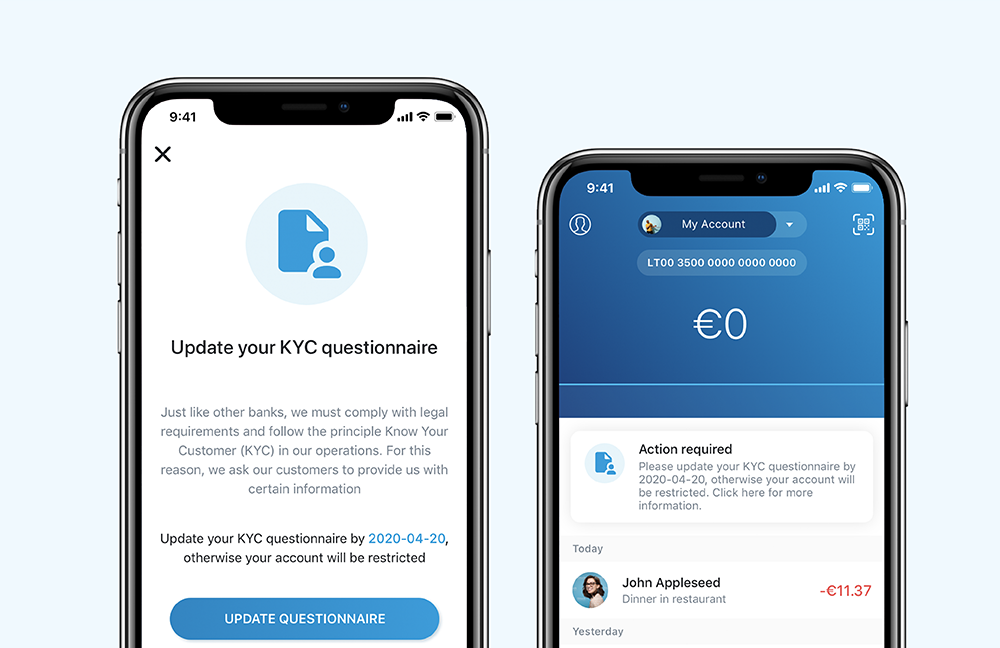

KYC Questionnaire

Everyone who registers to be our client has to fill out a so-called KYC questionnaire (Know your customer). And yes, we read it. It only takes a minute to fill out and if you provide all the necessary information you will be able to use your account immediately.

Make sure to describe your activity as accurately as possible so we don’t need to send you any follow up questions. It can take up to 5 days to check the questionnaire and we normally request to update it annually or if any major changes occur.

How long does the restriction last?

It’s all in your hands! If you provide all the necessary documents and information the restriction can be lifted that very same day. However, if your account is restricted or your payment is reserved and you don’t cooperate – it can take weeks, even months – until you answer all the questions that we need to move forward.

How can you avoid it?

Stick to the rules. Honestly, it’s as simple as that. Don’t be late to fill out your KYC questionnaire, provide the documents we ask for, be transparent about your activities, and simply don’t lie.

If when making a larger payment you only write the invoice number – it doesn’t say anything to us. Attach the invoice to the transfer. But if the invoice only says that the sum is paid for “IT services according to the agreement”, that’s also not enough, we will need to have the agreement as well. Think about these nuances in advance and all the transactions will pass smoothly, within moments.

Also, don’t joke. Paysera is a team of fun and jolly people, however, when it comes to money and rules – we keep it serious. Payments for “guns and roses” and “mcksmaeoromksmkc” (random letters) can and will be held. So, let’s save each other’s time.

Will you lose your money?

No. Unless it wasn’t yours to start with. If you committed fraud against other people and they contacted us with proof, the money will be returned to the victims.

If it was a simple breach of other rules, we will return the money to you, prior to closing your account. It is worth noting that we can only return money to YOUR bank account. It can’t be a relative's or a friend’s.

We always do our best to be transparent as well as just and patient with our clients. We honestly hope that you will never find yourself in a situation where you have to read all of this to understand why your account was closed, as we also don’t like saying goodbye to our clients. However, to protect you and others, such procedures sometimes have to be taken at Paysera as well as any other financial institution.

If you have further questions – read more about the Know your customer procedures on our website as well as the frequently asked questions on this matter.