How to open a Paysera account?

Why should I open a Paysera account?

Open a FREE Paysera account today!

REGISTERHow much does it cost to open a Paysera account?

Opening a personal Paysera account is free of charge and there is no monthly administrative fee either. Additional charges apply only to extra services like card ordering and maintenance, and so on. All of them can be found on the Paysera website.

How to open a Paysera account? Step-by-step guide

1. Register with your phone number

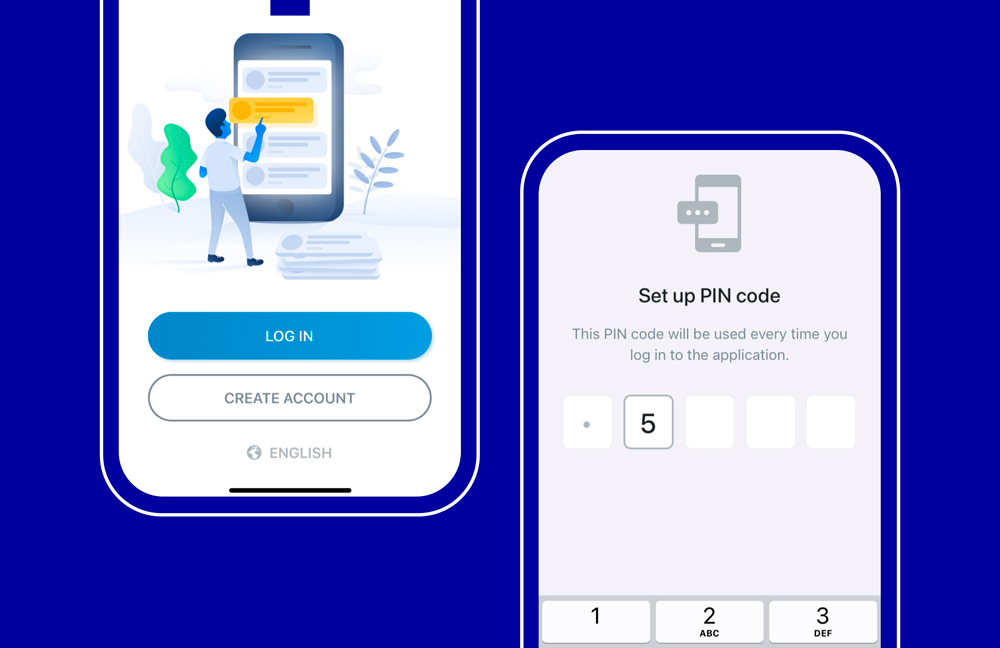

Open the Paysera mobile app, choose your language, and press Create Account.

Enter your phone number and create a strong password (at least 8 symbols). This will be your password for the Paysera online banking – bank.paysera.com.

You will receive a confirmation code via SMS. Confirm your phone number by entering this code in the application.

2. Create a PIN code

Create a 5-digit passcode to unlock the Paysera app on your phone. You will have to enter it every time you want to use the application. Biometric identification, such as a fingerprint or face recognition, is also available if supported on your device.

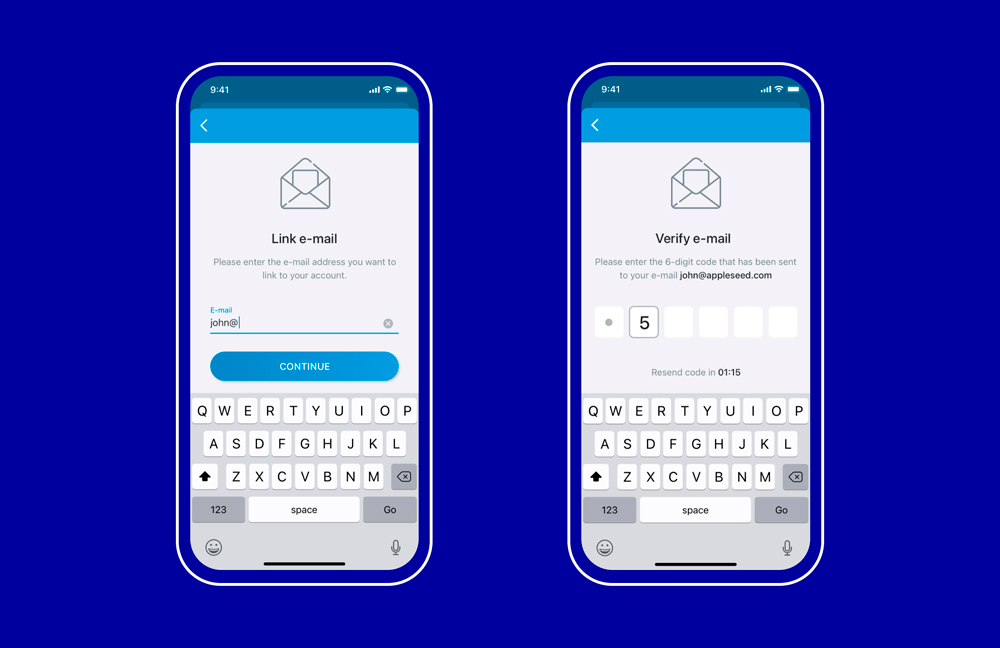

3. Confirm email address

When you’re ready, confirm your email address by dialing in the confirmation code, which you should have received to email address you registered with.

Remember: the email associated with your Paysera account and your confirmed phone number are used for communication between you and Paysera, so you should carefully secure access to them.

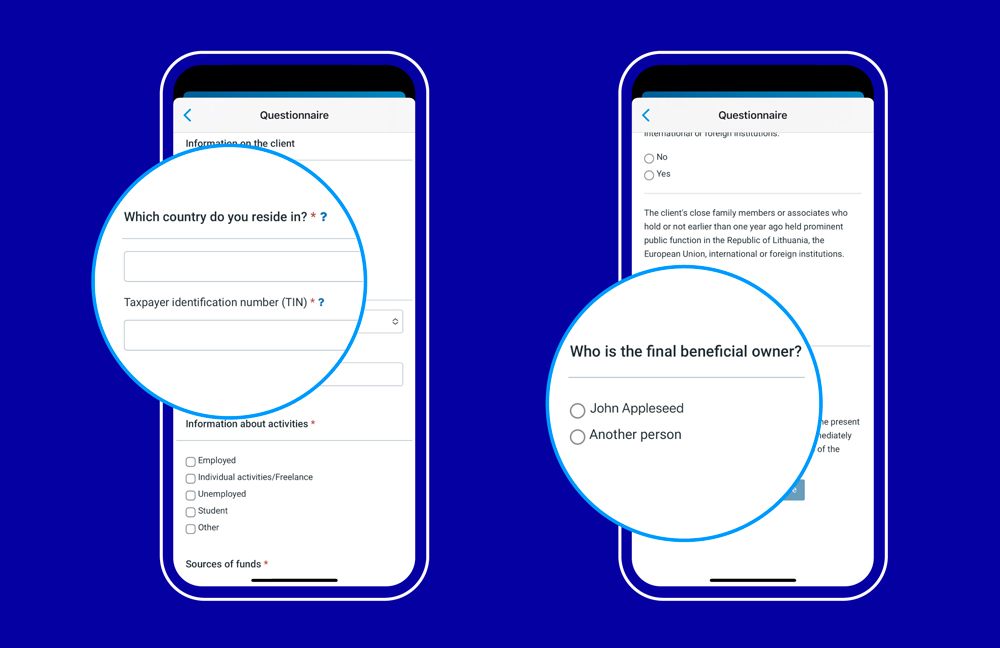

4. Complete the KYC (Know your client) questionnaire

KYC questionnaire completion is a legal requirement for all clients.

It requires answering a few questions about your financial status, such as:

- What are the most common sources for your funds? Maybe it’s your wage, or maybe it’s scholarship money.

- What is your expected monthly turnover?

- Do you expect to receive up to 1,000 EUR per month to this account or closer to 10,000 EUR?

- Do you or your relatives hold any political positions?

Finally, confirm whether you are the person who will be using this account.

More information on the KYC questionnaire >

5. Take a photo of your ID or passport

>To confirm your identity, you must submit a document – your passport or identity card. Choose from the menu the document that you will use.

For the ID card, you need to take two photos – the front and the back of the document. If you choose the passport, you will only need to take a photo of the basic data page.

Rotate your phone horizontally to landscape orientation (90° to the left) and make sure the document data is visible and readable.

6. Take a selfie

Once the document is submitted, you must take a picture of yourself (a selfie) to make sure you are the same person as on the provided document.

Make sure your face is clearly visible and positioned in the frame. You must be alone in the photo and must not be wearing a hat, sunglasses, or other face-obscuring items.

You are ready! Your account is open!

Congratulations! You have completed the Paysera registration process. Your documents will be verified within 1 business day, and then you can start using your account, sending and receiving money, exchanging currency, shopping online, and more.

How to top up my account?

In order to make your first transfer via Paysera, you will need to top up your Paysera account. You can do this by making a regular bank transfer, depositing cash at any EasyPay office, or through an ePay micro account. Read this detailed guide on how to add funds to your Paysera account to get started.

Have questions? We would be happy to assist you!

Contact us via phone or email.

Useful reads for new clients

If you are new to Paysera, check out these pages and start exploring:

- What are the differences between Paysera mobile and desktop versions?

- Where to check if Paysera is (not) working?

- How can I contact the Paysera client support?

- Why is my Paysera account blocked or restricted?

- Follow Paysera on social media channels and get notified about the latest updates and new features!